Prediction markets will eat themselves

Plus: offbeat futurology, repo, the Treasury basis trade, vibe coding, gilts, HS2, and merch

We’re Alphaville, a Financial Times blog about markets, finance and economics. Each Friday, we send a newsletter that bundles together the team’s work with some interesting stories found elsewhere, topped and tailed by commentary and charts. The newsletter’s completely free, just like Alphaville.

We’re always open to finding out how we can do better — let us know by filling out this short and anonymous survey.

Sharkbait

Prediction markets mostly take bets on sports while offering a few specials and novelties. By revenue, this is pretty much exactly the shape of every online betting service launched over the past 30 years. But because they’re marketed to Americans, who for historical reasons are weird about gambling, and because their specials and novelty bets help create news, prediction markets are hot.

The other thing everyone knows by now about prediction markets is that they’re not for gambling: they’re offshore exchanges for trading derivatives in the commodity of truth. And even though the Commodity Futures Trading Commission’s rules prohibit the making of event markets related to “gaming”, the US regulator keeps twirling its pigtails when asked for clarity, so we’re obliged to pretend that definition makes sense.

It’s all extremely silly and more than a bit dystopian, but while hot money is available, we’re requested not to think too much about it.

However, one downside of putting bookmakers behind a layer of faux financialisation is that it attracts real finance types. The FT reports:

Trading groups are expanding into the rapidly evolving realm of prediction markets, hiring traders to arbitrage fleeting price discrepancies between contracts for events such as football games and elections. […]

Don Wilson’s DRW is looking for a trader who will be paid a base salary of up to $200,000 to “monitor and trade active markets in real time” across Polymarket and Kalshi, according to a job advert posted last week, as it builds a “dedicated prediction markets desk”. Options trading giant Susquehanna is on the hunt for traders to “detect incorrect fair values” and identify “unusual behaviours” and “inefficiencies” on prediction markets, as well as people to work on its dedicated sports trading desk. Crypto hedge fund Tyr Capital hopes to hire a prediction markets trader “who is already running sophisticated strategies”.

This might look like natural territory. Prediction markets are full of retail money. Retail money is attractive to liquidity providers because it provides healthy order flow with manageable pricing risk. That’s how it worked with meme stocks and crypto, which can be seen as cultural bedfellows to prediction markets.

But prediction markets differ from meme stocks and crypto because the latter two don’t involve fundamentals. There’s almost nothing useful a trader can learn about Gamestop and Fartcoin that will inform tomorrow’s price, but having non-public information about a real-world event will turn any wager into a sure thing. A prediction market hangs on one fundamental: “true” or “false”. Offering liquidity to that market in ignorance is inviting everyone with better information to wear you as a hat.

Bloomberg’s Matt Levine suggests that, to tap prediction markets while avoiding adverse selection, trading firms might hire teams of experts and create proprietary world-event research functions. Another possibility is that they don’t. The more cost-efficient path may be to arbitrage already popular markets with unknowable outcomes, meaning sports, while leaving everything else to wither.

What’s happening in effect is that the likes of Susquehanna and DRW will do the kind of flow management functions that traditional bookmakers like Ladbrokes and Bet365 handle internally. Nearly any bet on the platform remains a bet against the house. (Lex has an interesting note on their apparent win rates so far.)

For European investors, who’ve been talking about the limitations of peer-to-peer betting since the early 2000s, a lot of this stuff may feel like familiar territory. Take, for example, online poker. That bubble popped after US regulation changed overnight, but had already been in decline as over-financialisation sucked all the fun out of playing.

New poker players were finding their wallets drained by experienced types who played the odds methodologically, and/or by bots that did the same 24/7. It became known as the sharks-and-fish problem: once every poker table was populated by sharks, the survival time of any stray fish could be measured in minutes. Customer retention crashed. And, once all the fish had gone, the sharks followed.

What’s easy to overlook in the prediction market hype is that gambling is a branch of the entertainment industry, not a financial service. To attract new customers, gambling needs to seem fun. Winning is fun. Losing to a gamma-neutral Sequoia market hedging algorithm that snipes for mispricings and whittles away every inefficiency is not fun. Neither is it fun to lose to insider traders who’ll flush any market that benefits from an informed view. No one volunteers to be sharkbait.

Prediction markets won’t disappear overnight, at least under the current administration, but will probably go the same way as NFTs and memecoins. The excitement of giving money to insiders via online marketplaces soon wears off. What will remain will be sportsbooks, plus a few low-stakes novelty markets offered as loss leaders for marketing purposes.

In summary, America’s great “truth machine” revolution will have reinvented Paddy Power.

Meanwhile, in the marketplace of ideas

Alphaville has been ill this week, so some of the material held for review was to confirm it was genuine and not the result of a fever dream.

For example: did Barclays really publish a prediction cluster-bomb that charts by likelihood and impact 150 trends for 2035 that include insect protein, tax reform, psychedelics, extended reality, women’s empowerment, and a myopia epidemic? Remarkably, the answer is yes.

And, having last week sent clients a futurology-themed playlist, did Morgan Stanley analyst Adam Jonas really publish a meditation on “an acronym for the Muskology: MARS” that quotes Socrates and Star Trek in support of arguments like “the need to dig into the Martian regolith will be critical for a permanent settlement”? Again, yes.

Sell-side research quality has been eroded by regulation and the rise of passive investing, so it’s good to see it can still thrive when measured by variety.

The week on Alphaville

○ So is the Treasury basis trade, which now accounts for 6 per cent of the US government bond market.

○ Is the US about to screw sovereign wealth funds?

○ Subscriptions like Netflix don’t count towards UK retail spending.

○ Everything bad that happens was probably Bill Pulte’s idea.

○ Terry Smith is having a bad decade. His customers are paying.

○ In its enthusiasm to think about how robots might work, Barclays seems to have forgotten how humans work.

○ Boaz Weinstein expects the owner of 63 quirky London serviced offices to find buyers for the whole £2.3bn portfolio at or near to appraisal values within 12 months, because of course he does, he’s Boaz.

○ In light of Polymarket’s sponsorship of the Golden Globes, a look at the interplay between US box-office wagering and onion derivatives regulation.

○ What caused UK retail’s tilt to gilts?

○ The European Union is very keen right now on defence companies raising money, so has made nuclear weapons ESG compatible.

○ Donald Trump leaked jobs data on his vanity website and no one noticed or cared enough to believe him.

○ Various gifs about a research paper about measuring investor sentiment with gifs.

○ The FTAV merch store now stocks Free Jay Powell T-shirts and hoodies.

Best of Further Reading

○ Who captures the value when AI inference becomes cheap? (This Is Not Investment Advice)

○ Postal arbitrage (Walzr)

○ All Gas Town, no brakes town (Today In Tabs)

○ There’s a ridiculous amount of tech in a disposable vape (John Graham-Cumming)

○ Animal Crossing: New Horizons is a time capsule full of 2020 anxiety (Polygon)

○ How to become a tree (Aeon)

Chart blast

○ HS2 is very expensive for various reasons, as outlined in this graphics-rich MainFT long read. Go to the comments for an argument.

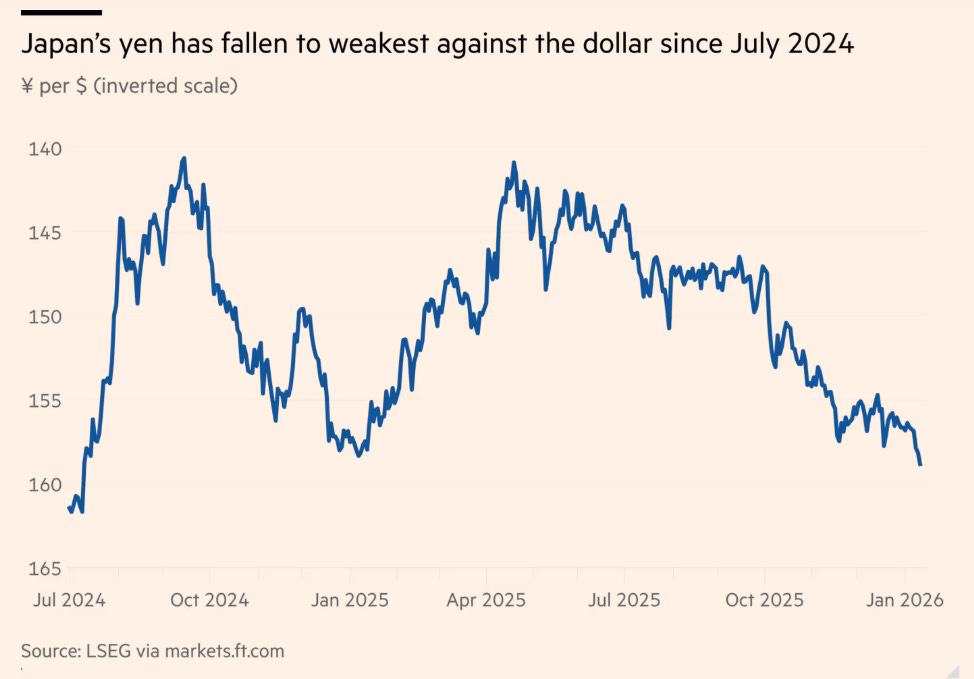

○ The Takaichi trade is back!

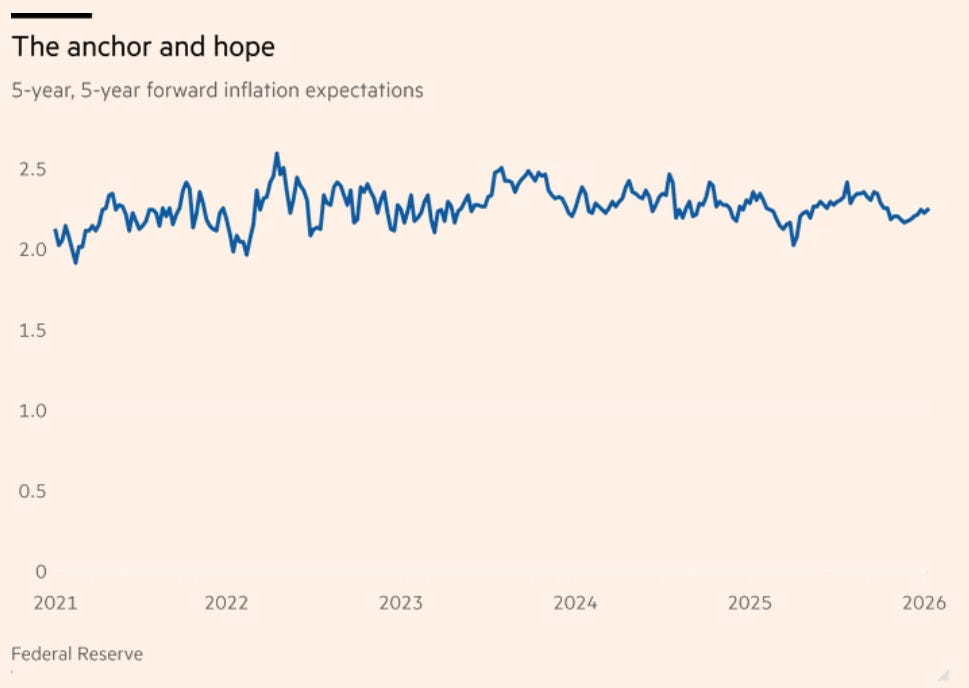

○ An Unhedged note on the market’s non-reaction to the Trump administration’s criminalisation of the Fed contains this dull chart and excellent headline.

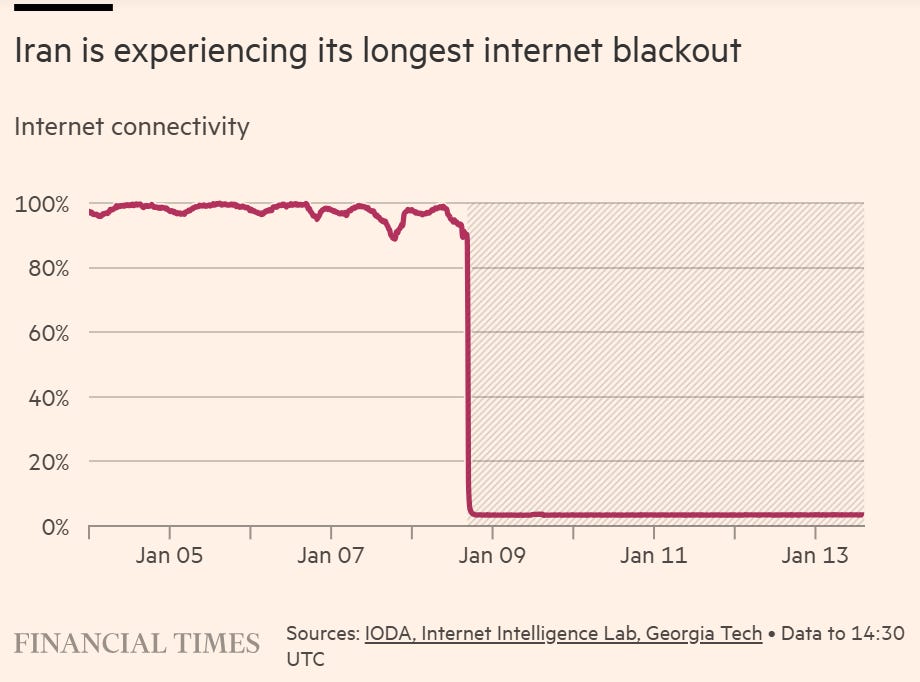

○ From “how Iran switched off the internet”. Not to make light of the circumstances, it’s good to know that’s an option.

What have we missed? What did we get wrong? Where can we improve next week? Let us know by email or this anonymous survey.

Disclaimer: I wrote Sequoia as a placeholder because I wasn't confident in my spelling of Susquehanna, then forgot to change it. My apologies to Sequoia for dragging them into this.

Great post!