Bitcoin printer go brrr

Plus: Japan's remarkably profitable prop trading desk, the great software reset, prediction market manipulation, and why everyone loves to hate America

Hi, we’re FT Alphaville. Here’s this week’s roundup. It’s free, like the blog.

The Gospel of the Immaculate Blockchain

Crypto, it’s often said, is a speed run of Finance 101. By creating from scratch an asset class that was insulated from reality, then making every mistake it was possible to make, crypto has been an expensive but mostly harmless way to teach finance from first principles.

It’s also said about bitcoin in particular that learning has been by devotional study. And fair enough, it’s a good story: from the annunciation by lowly mailing list to a conception most miraculous (an academic who didn’t want credit), plus numerous wise men and an escape plan from a tyrannical establishment. Short of swaddling baby Satoshi in a tea towel and singing about cattle, the callback couldn’t be clearer.

But with bitcoin turning 18 years old in October, maybe it’s time to mark the end of the elementary phase and treat everyone involved as adults. Here’s something that happened this week:

Susquehanna-backed crypto lender BlockFills has halted withdrawals and restricted trading on its platform, underscoring the strength of the recent tremors that have shaken the digital asset market.

The Chicago-based company, which in 2025 handled $60bn in trading volumes, has suspended client deposits and withdrawals as the price of bitcoin and other crypto assets has swung in recent days. The suspension was put in place last week but remains in effect, BlockFills told the FT.

The obvious echo is with 2022, when the gating of token shops started a domino effect that knocked over Three Arrows Capital, Celsius Network and FTX, among many others. Where it differs is the lack of amateur dramatics.

Crypto Winter was preceded by an altcoin sell-off and the bursting of the NFT bubble, both of which were widely anticipated, because altcoins and NFTs never seemed anything other than ridiculous. Bitcoin was insulated for a while thanks to demand from newly created ETFs and digital asset treasury companies, which people mistook for sensible money. It was only after the failure in May 2022 of TerraUSD, a stablecoin made of nonsense and fraud, that institutions began to question where all the tokens were.

This time round, with bitcoin nearly 50 per cent below its record high, we’ve skipped the preamble and gone straight to the action. Blockfills is a very grown-up sort of business, a CME-backed crypto intermediary that deals with clients who have at least $10mn in tokens. It’s not entirely expected for the first signs of distress to be at a broker for institutions and high-net-worth individuals.

The other big news in crypto this week involves Jeffrey Epstein, another broker of sorts for institutions and high-net-worth individuals. Recently released emails give weight to the allegation that, in 2015, Epstein funded a team at MIT that steered bitcoin’s development away from internet money and turned it into a digital bearer bond.

Whether the involvement of a convicted paedophile tarnishes bitcoin’s Genesis story is a question for the faithful, so is none of our business. More measurable are the after-effects.

For the past decade or so, bitcoin has been marketed as digital gold. That’s awkward, firstly because bitcoin hasn’t been a store of value, but also because the gold market looks a lot like the kind of deflationary fiat money system bitcoin was proposed to fix. Goldsmiths invented fractional reserve banking in the 17th century by issuing loan notes, pretty much, and the value of paper gold in circulation dwarfs the trade in physical gold, which to a lot of people seems a bit suss.

But gold futures are contractual claims on gold, underwritten by 6,500 years of uncovered scams and contested practices. The link between crypto futures and on-chain crypto can be more hazy. Neither side of a bitcoin perpetual futures contract ever needs to own a bitcoin, for example, any more than punters and bookmakers at the Kentucky Derby ever need to own a horse.

It’s hard to figure out how much of the $50bn or thereabouts of bitcoin futures open interest has on-chain backing, but why assume it does? When a race has no finish line and is run via numbers on a screen, why involve horses at all?

We don’t know. BlockFills’ gating of funds may not turn out to be significant, but it’s still interesting. It suggests institutions aren’t waiting to find out where their tokens are. Below them are small-time gamblers with voided betting slips referencing tokens that may or may not exist. The big idea of bitcoin scarcity has been replaced by a crypto paper-printing machine whose fractional reserve can go all the way down to zero, and all the wise men left the scene a long time ago.

A week in Alphaville

○ The Epstein files are a Rorschach test: everyone sees in them what they hope to find. Rob Smith went in search of evidence for a subprime crisis conspiracy theory, debunked it, and replaced it with an even better conspiracy theory.

○ Phenomenal gains from shorting the yen and punting stocks make Japan’s debt burden look a lot less alarming.

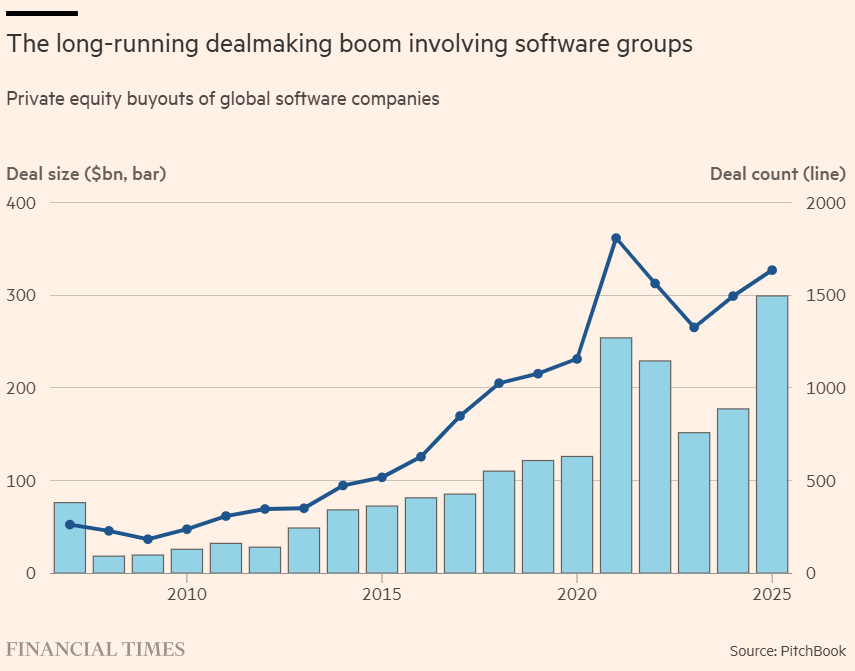

○ Will SaaSmageddon eat private credit? We can’t tell you that, but to help you form a view, here are some nice charts of software exposure among business development companies.

○ Now that US sheds with contracted electricity supplies are more profitable to use as data centres than for crypto mining, where does that leave bitcoin? In Russia, probably.

○ First-draft thoughts on Nuveen’s agreed offer to buy Schroders.

○ A map of nearly $1tn of university endowment assets and what they’re invested in.

○ For the renminbi to become the world’s reserve currency, what has to happen?

○ Want a job in the US? Try being a nurse.

○ Reflections on Trump’s crackdown on residential rentiers.

○ Sure-thing bets on prediction markets look sort of like illiquid, badly drafted bonds.

○ Bets on sure-thing bets on prediction markets are somewhat spicier, for very-obvious-market-manipulation reasons.

○ Central bankers are revolting.

○ Anyone who invests in an Aim-quoted miner, or who reads The Spectator, should probably know what to expect by now.

○ The ONS is worried about media misrepresentation of their door-knockers.

○ Norway’s central bank is going to publish meeting minutes, so apologies in advance.

○ Extel voting is now open.

○ Chart quiz.

Promotional interlude

○ Alphaville will turn 20 years old this year. Help us celebrate by sponsoring a pub quiz or an Art of the Chart show. It’s a unique opportunity to get your company’s name in front of the brightest people in finance, our readers.

Best of Further Reading

○ Harvard Business Review has a study on how AI is intensifying workloads, not reducing them.

○ Rupak Ghose looks at Bloomberg’s landmark deal with Merrill Lynch as an example of how partnerships build companies.

○ Hanno Lustig’s The Two Cents blog considers “the safe assets that weren’t”.

○ Les Barclays’ latest is on the financialisation of football.

○ From TheAltView, a look at how the performance of Ares’ private markets fund “has benefitted from NAV-squeezing”.

○ Hamilton Nolan, of How Things Work, implores you to remove your Ring camera with a claw hammer.

○ Ever since the FT newsroom was instructed to go woke, we’ve been maintaining a presence on Bluesky, the least brain-itchy of the short-form social networks. Here’s a neat toy that maps 3mn Bluesky accounts by follower connections.

Chart blast

○ Software and AI see a lot of coverage this week, including in this long read on private equity exposure and this Unhedged newsletter.

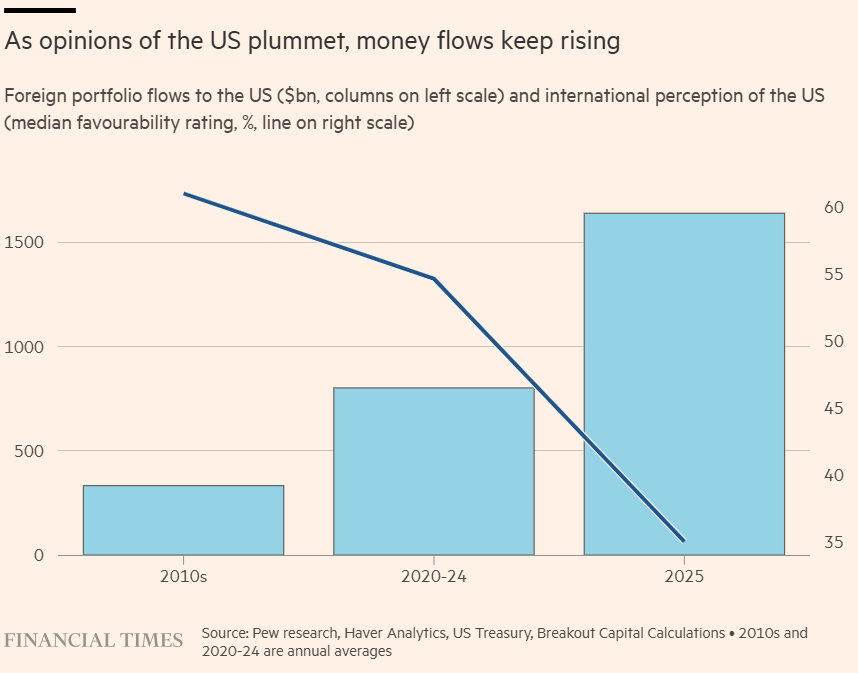

○ Rockefeller International chair Ruchir Sharma considers why, when it comes to the US, hardly anyone is putting their money where their mouth is.

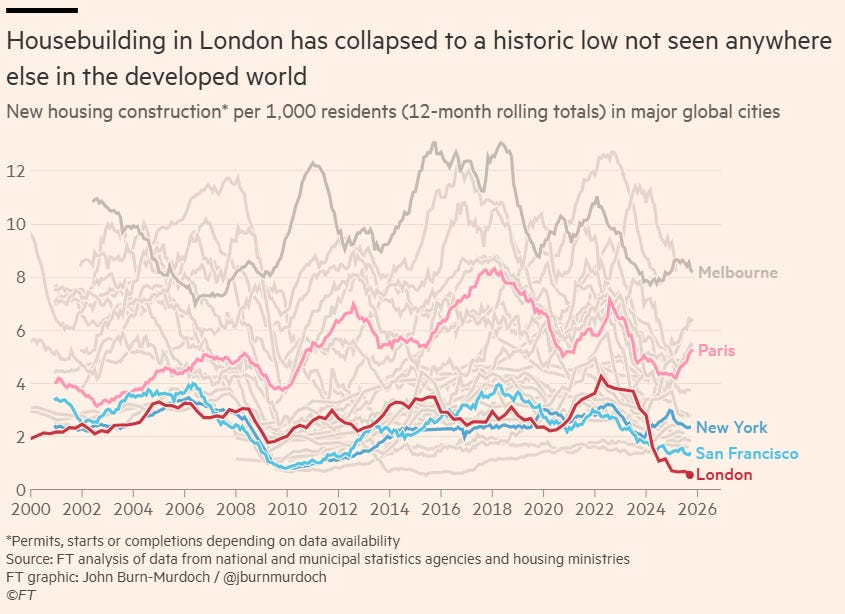

○ John Burn-Murdoch’s latest is on London’s lack of new houses.

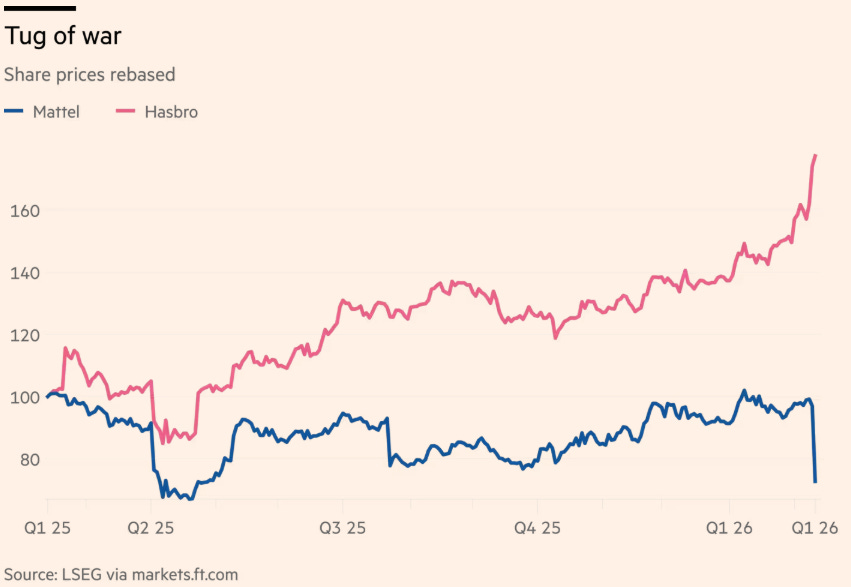

○ Hasbro’s done well with trading cards while Mattel struggles with dolls, explains this Lex note.

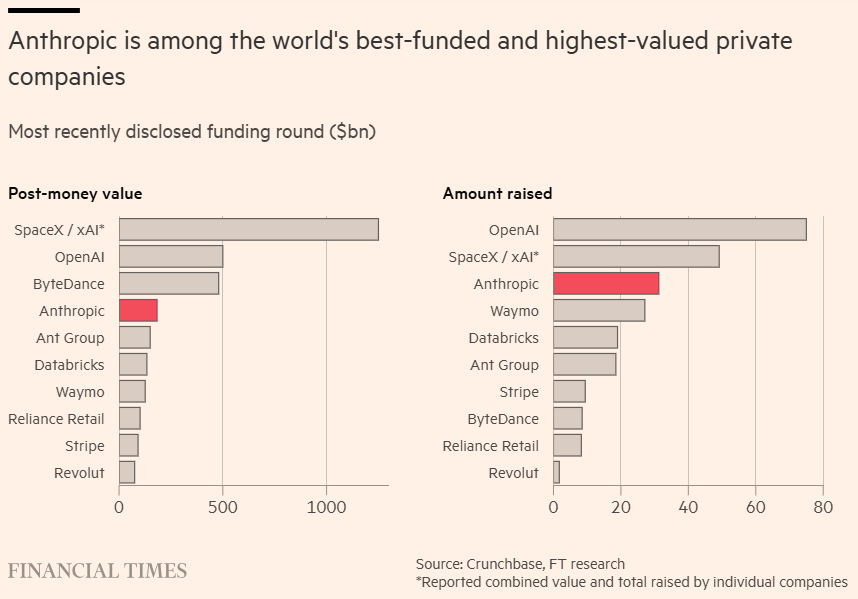

○ That’s from a chart-heavy look at Anthropic, which was almost immediately stale after the hypey chatbot maker raised another $30bn on Thursday.

What have we missed? What did we get wrong? What can we do better next week? Let us know at alphaville@ft.com.

Nice summary.

FT Alphaville is confusing the failure of System A’s plumbing with the failure of the asset itself. When a broker like BlockFills halts withdrawals, it’s not Bitcoin that has failed—it’s the counterparty credit of a centralized middleman that has collapsed. If a gold vault locks its doors because the manager gambled away the bullion, you don't blame the gold; you blame the fraud. The "paper printing machine" FT mocks is actually the mess created by System A intermediaries who issued more IOUs than they held on-chain. Real Bitcoin, guarded by 800 EH/s of physical energy, is the only asset in the world that cannot be printed.

The attempt to smear Bitcoin with Epstein’s name is a desperate narrative distraction. The physics of the hashrate doesn't care about social gossip. Furthermore, the migration of miners to Russia isn't a retreat; it’s Energy Arbitrage. As System C’s application layer (AI) outbids the West’s grid, the settlement layer (BTC) naturally flows to System B’s energy surplus. This is a cold, rational optimization of Joules. FT is still using an old map to criticize a new continent—they are mistaking the broken pipes of their own world for a leak in the bedrock of ours.

Coming Soon: The financial world is still trying to price a 21st-century physical asset with 19th-century mental models. In my upcoming report, "Bitcoin: The Native Base Currency of System C," I will dismantle these category errors once and for all and reveal the mathematical "Hard Floor" that no banker can print away.