Agentic AI is everyone's problem

Plus: art lending, sanctions evasion, US inbound tourism, Covid, online dating, blue-collar work, and Gesamtkunstwerk

Hi! This is FT Alphaville’s weekly roundup. It is, like the blog, completely free.

Don’t fear the repo

Approximately $300bn was erased from global stock markets this week because someone updated a GitHub.

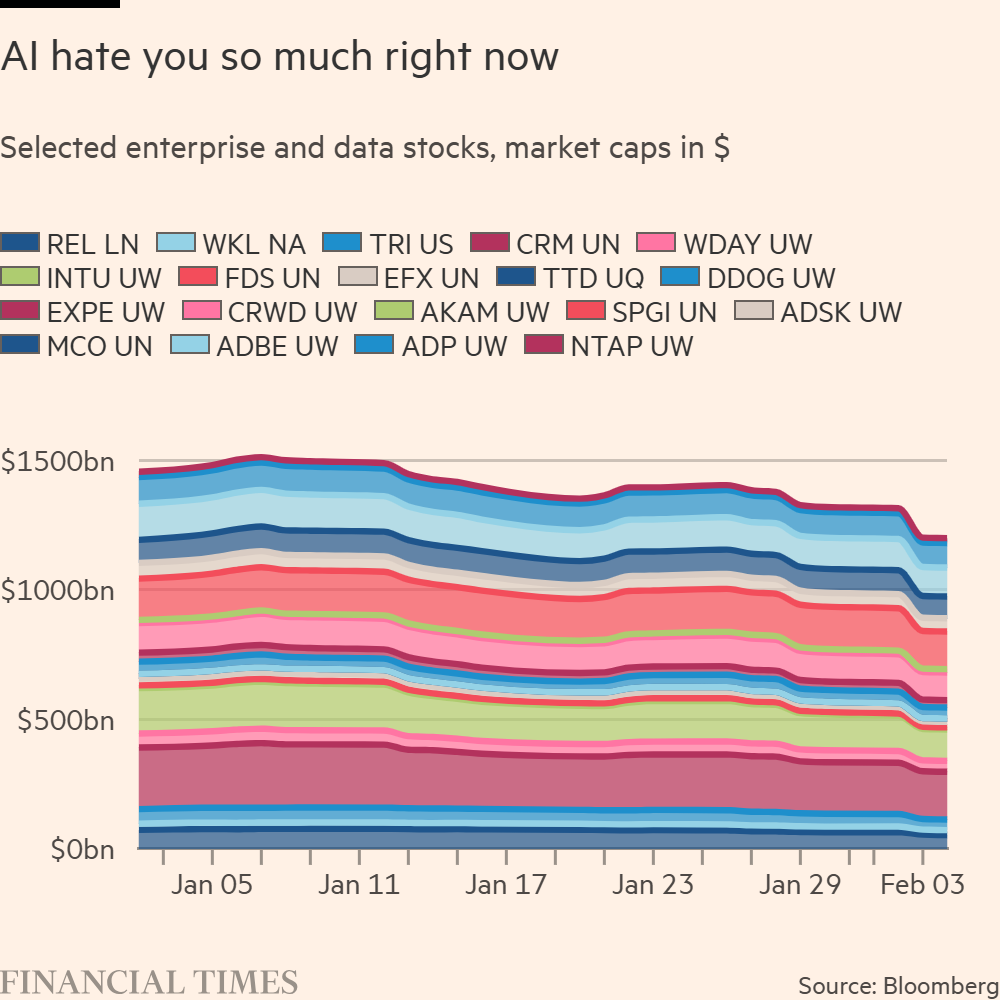

OK, that’s a simplification. There are plenty of reasons for being on edge right now, especially about the prices of things. Heaps of speculative money have been moved around on talk of reflation and debasement. The AI trade is at risk of Milhousing, as is private credit’s mark-to-mystery trade. Software and enterprise media stocks — the focus of selling early this week — were already comfortably the year’s worst performers and, as crypto is demonstrating, a crash doesn’t need a catalyst.

Still, it’s notable that the first proper AI-related selloff since DeepSeek more than a year ago was triggered by something so prosaic as a software update.

The person doing the update was Matt Piccolella, a product manager at Anthropic. Last Friday, he added “knowledge work plug-ins” to a code repository for Claude Cowork, the company’s desktop management system. There was no official announcement or Anthropic press release, probably because it didn’t seem particularly newsworthy. Cowork was launched a month earlier and is nothing more than a user interface for Claude Code, which has been around since February 2025. The plug-ins he made available promise to help with menial stuff like client onboarding and email triage. The documentation is stacked with warnings to never leave them unattended.

NBD, right? From the Wall Street Journal and Barron’s to The Daily Telegraph, the media had already covered Cowork’s launch with “paperless office” type stories. Analysts were able to draw on back-catalogues of research compiled over many years about how software and data companies have competitive moats made of trust, proprietary information and subscriber inertia.

What was overlooked is that agentic AI has been sending everyone a bit loopy. Claude Code is viewed as a generative AI sandbox in the same sense that the Sonoran Desert is a sandbox: it’s a huge off-grid borderland that attracts those seeking wealth, enlightenment, degeneracy, freedom to experiment, or toads to lick.

An upgrade in November gave Claude Code’s agents more autonomy, which bloomed in a million unpredictable ways: Gas Town’s vibe-coding suite, the Moltbook procedurally generated Reddit-alike, the OpenClaw life processor ... It’s all chaotic, exciting and otherworldly in ways that just to talk about it can make a person sound like a bit of a berk.

But let’s be realistic. Companies are bound by what’s rational, not what’s possible. No law practice is going to let a chaos engine replace its LexisNexis subscription. No accountancy firm will wear the risk of botswarms doing P&Ls. Cowork GitHub’s modest list of office management-type tasks available for partial automation probably gives a fair reflection of where we are, and will be for a while.

So. NBD, right? Maybe, maybe not. Software and data services companies could still emerge as the losers, but so could everyone else.

Where we are with agentic AI feels a lot like the cloud computing boom of 20 years ago. Marketed on claims of efficiency and flexibility, its big innovation was to remove friction between a company’s operating expenses and revenue lines of Amazon, Microsoft and Google.

Whereas project purchasing decisions once had to go through Procurement, virtual machines can now be spun up in moments at a cost of a few dollars an hour. It’s impossible to guess how much rented hardware is left idling, never to be noticed again within the IT department’s Rube Goldberg machine, but experience tells us it’s likely to be a lot. Better waste management is one plausible explanation for why companies have been abandoning the cloud and bringing servers back on premises.

Office management by agentic AI promises to be all of this but much, much worse. For example, this chap slop-coded a reminder to buy milk and found it had a running cost of more than $13,000 a year. Extrapolate that level of misspend across dozens of workflow bots running on millions of poorly monitored corporate networks, with everyone being charged by one non-itemised monthly bill, and those AI return-on-investment projections start to make a little more sense.

A week in Alphaville

○ Robin went on a vision quest through the Federal Reserve’s FOMC transcripts from 2020 and emerged with this epic post about crisis management.

○ Josh Spero, FT Wealth editor, gives us a tour of art collateralisation as told through a Cezanne he spotted in the Epstein files.

○ A deep dive into how much BNP Paribas might pay for criminally breaching US sanctions against Sudan.

○ Michael Saylor’s Strategy is underwater on its bitcoin purchases. Craig Coben, unofficial biographer to the OG bitcoin treasury company, considers its options.

○ Craig also wrote about the lessons to learn from Figma’s IPO, which has gone very quickly from underpriced to overpriced.

○ A European buyers’ strike doesn’t have to be formal or coordinated to have leverage over the US, argue professors Paola Subacchi and Paul van den Noord.

○ The digital euro makes most sense when seen as an alternative to America’s credit card duopoly, writes Dan Davies.

○ PIIGS, an acronym coined 15 or so years ago that bundled together Europe’s perceived weaker nations, has not aged well.

○ A look at why productivity among US construction workers has been on the slide for 50 years.

○ The US jobs report may be an odd one, whenever it arrives.

○ Sell-side analysts are often wrong, but they’re rarely wronger than they were about SanDisk.

○ One luxury of blogging is being able to write the same post whether the price of a bitcoin goes up or down.

Best of Further Reading

○ Prediction market maker Kalshi has put itself in a weird fight with an analyst and a tiny data shop he cited, as Bloomberg ($) explains.

○ Liberty Street Economics comes to praise the Phillips curve, not bury it.

○ Portfolio Design as Gesamtkunstwerk is a white paper from AllianceBernstein strategist Inigo Fraser Jenkins, which you may have already guessed by its title.

○ From The New York Times, a dataviz that helps explain the US health insurance thing to those who don’t have to deal with it.

○ Data centres in space make no sense, writes CivAI.

○ NBER has a fairly optimistic paper about “how online dating platforms have impacted marital outcomes, assortative matching, and sexually transmitted disease”.

○ In Eater, a look at why British cooking is conquering America that steers away from stereotyping and cliche.

○ Journalist Allan Massie is remembered by his son Alex.

○ Random Wikipedia pages delivered as a sort of antidote to doomscrolling.

Chart blast

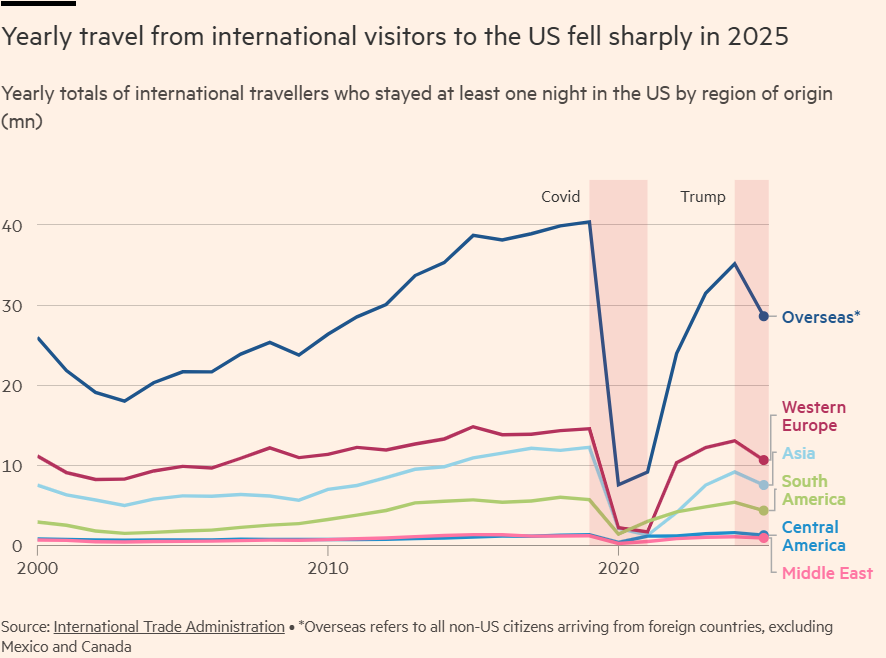

○ Donald Trump is officially less off-putting than Covid.

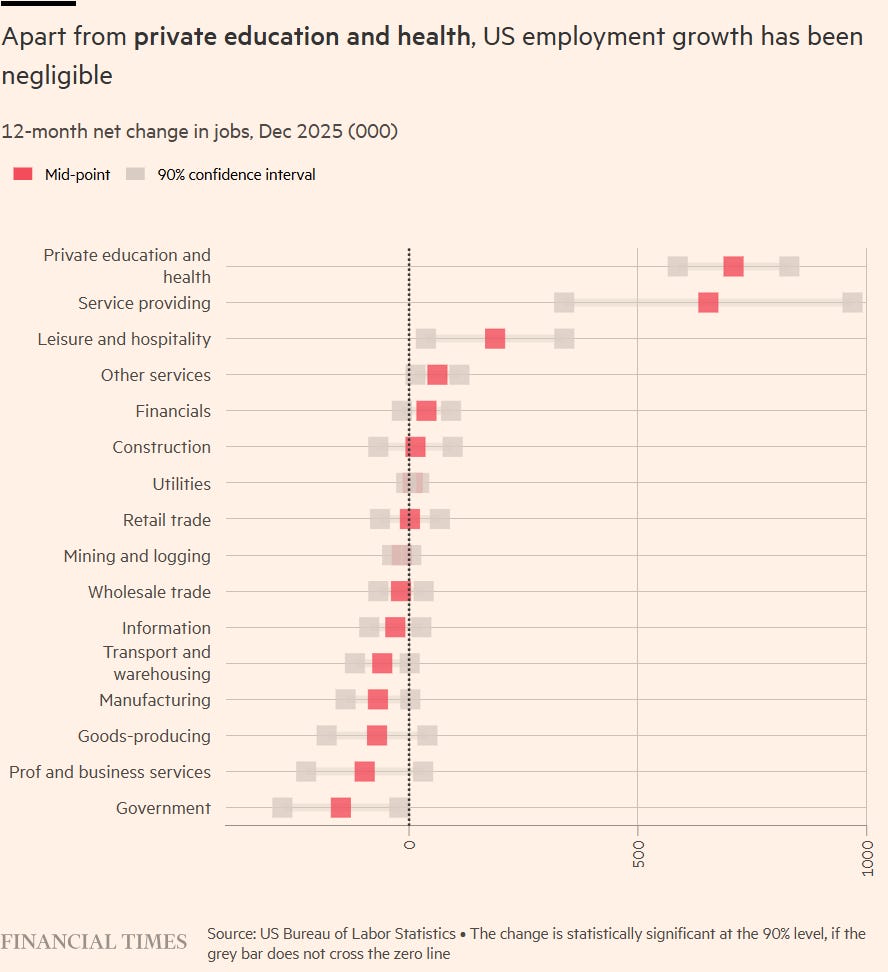

○ Labour market statistics contradict recent talk of a boom in blue-collar employment.

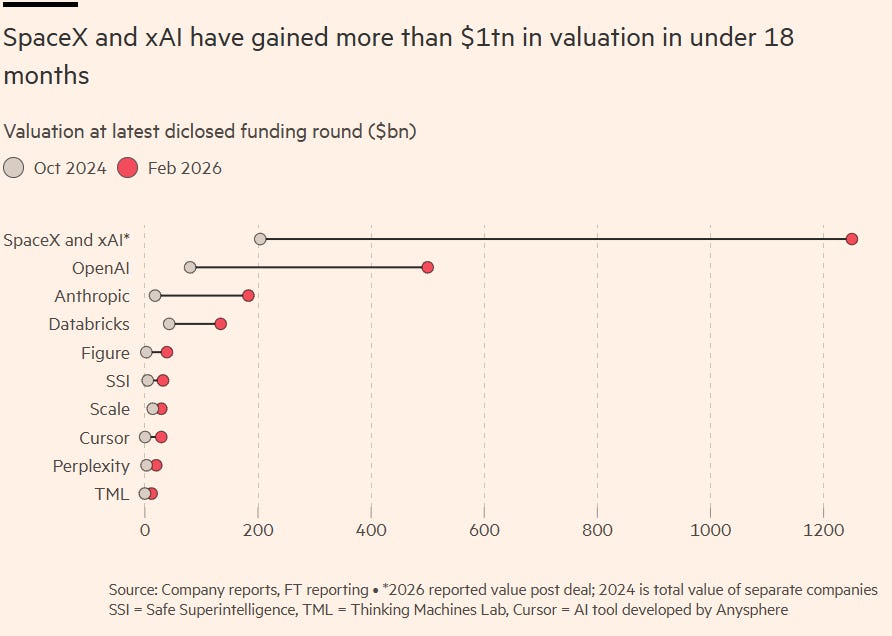

○ Elon Musk’s bailout of xAI with SpaceX is the subject of this long read.

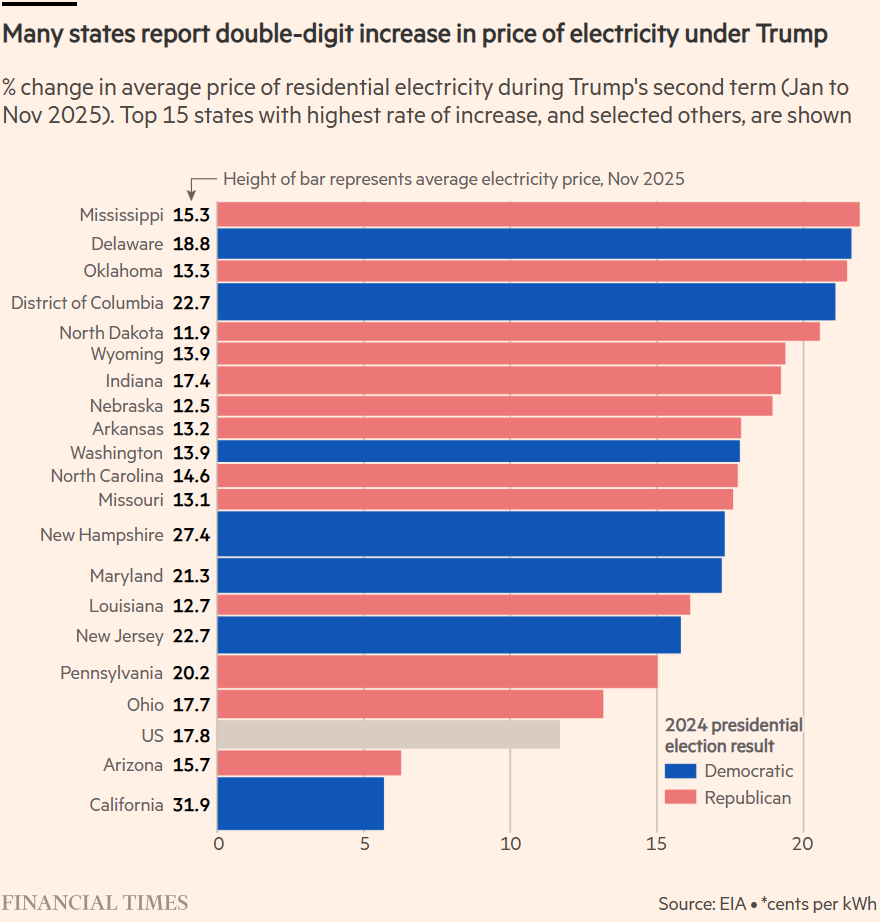

○ US electricity prices are to 2026 what eggs were to 2025.

○ Thanks for playing the metals markets, degens.

What have we missed? What did we get wrong? What can we do better next week? Let us know at alphaville@ft.com.

Don't fear the repo and AI hate you so much right now. We should be paying for this. I can't believe you're giving this away for free.

Pretty soon its shareholders who are going to be paying for these data centers not to mention higher electricity prices. If this movement doesn't create new jobs the labor market is going to deteriorate fast. Where are the people in America asking actual questions about this? While the Trump Administration benefits from hyping the technology and boosting crypto.

The demand for compute will go up exponentially and the bond market is going to end up paying for it. But death and robots is not how to finance an empire in decline or rejuvenate it.